On August 1st, U.S. President Donald Trump announced on Twitter that he would be levying a new 10% tariff on $300 billion worth of Chinese goods. He stated that the tariffs will go into effect on September 1st.

This was a surprise to many, as the United States and China had both just resumed negotiations in Shanghai after agreeing to reopen talks at the Osaka G20 Summit.

Announcements following the meeting seemed to be positive.

So as you would expect, Chinese President Xi Jinping and his negotiation team were probably caught off guard. Trump also commented to the media that, “We are starting at 10% and it can be lifted to well beyond 25%.”

The major difference between this round of tariffs and the previous ones is that it will directly impact consumer goods. These include things like smartphones, televisions, laptops, gaming consoles, toys, and footwear.

After the announcement, the U.S. stock market took a dive, with all the major indices losing around 3 percent or more.

How Has China Responded to the New Tariff Announcement?

Since the announcement, we’ve seen a couple of key things happen in Beijing.

The first is that the Chinese currency, the Yuan, plunged below ¥7.00 per dollar for the first time since 2008.

This indicates that the Chinese government is allowing currency depreciation as a countermeasure so that they can soften the impact on Chinese suppliers.

Second, they’ve responded by asking state-owned companies to suspend all imports of U.S. agricultural products. This is key since the U.S. negotiation team had been looking for an increase in agricultural purchases.

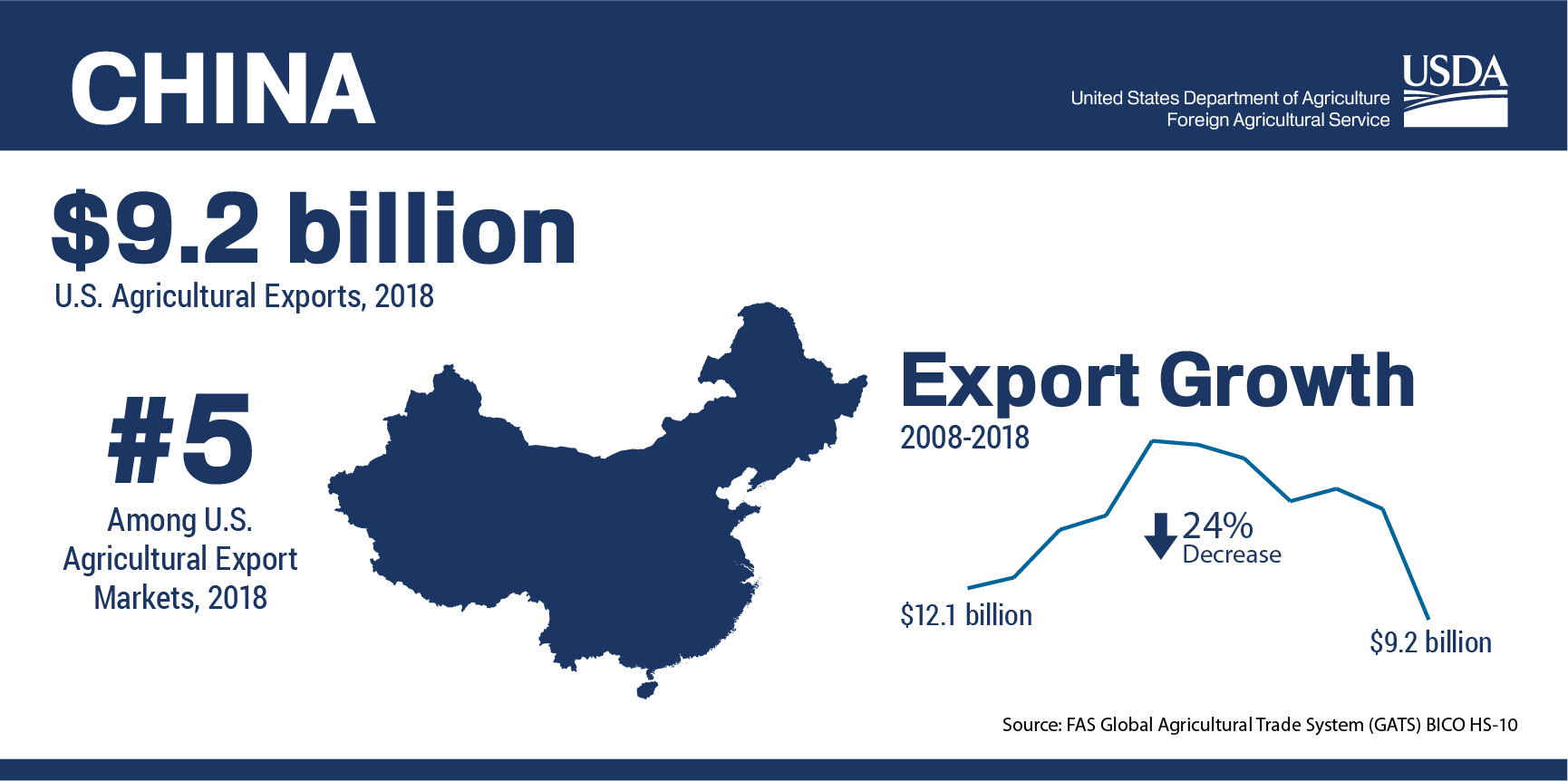

Source: USDA

According to the U.S. Department of Agriculture, the U.S. made $9.2 billion dollars worth of agricultural exports to China last year, and China is its 5th largest agricultural export market. This suspension of purchases will have an impact on U.S. farmers, especially those that produce soybeans.

Another potential measure that China might be considering is to develop its own unreliable entity list, making U.S. companies’ activities in China more difficult. Further, they may be thinking about a restriction on rare-earth mineral exports, which are needed by many tech companies in the United States for electronics production.

So, How Does This Affect Consumer Goods Importers?

In an unpredictable trade war, it is best to prepare for the unknown.

Keep in mind that China is letting its currency dip to the lowest level in a decade, and the 10% tariff could be pushed to 25% and beyond.

As the Chinese currency weakens, it becomes cheaper for Chinese factories to produce. But importers should plan on their costs going up because the importer is the one who pays the tariffs.

When thinking about how to manage pricing, importers should expect that the new tariffs will go into effect next month, as announced. There is, of course, a chance they’ll be rescinded, though.

The tariffs will affect anyone whose order hasn’t arrived in the U.S. by September 1st. This means it could make sense to weigh the cost of air freight if you want an order to arrive before that deadline.

We recommend that you don’t commit on pricing with your retailers or buyers too far in advance. If you do, it’s ideal to have a mechanism in place for renegotiating as the situation changes.

If the tariffs end up being rescinded, be willing to share in the gains with your customers. And, since there is a chance of an increase, have the conversation about how to handle that scenario, in advance.

Also, if you are considering new suppliers in an effort to diversify your supply chain, we recommend conducting factory audits, (i.e. capability assessments) to help you qualify your potential manufacturing partners.

Learn more about capability audits below.

Considering New Suppliers? Capability Audits Help You Evaluate Them

When you are considering a new supplier in a low-cost country, a capability audit can help you to determine whether they will serve as the right long-term partner for your needs.

These assessments help reduce the risk that comes from uncertainty when you can’t be at a supplier in person or don’t have the resources to conduct a full, detailed evaluation yourself.

0 Comments